Millionaires Who Owe NO Federal Income Tax- Is This Fair?

By Jeanne Sahadi

By Jeanne Sahadi

When it comes to taxes, do the rich pay their fair share?

The answer, of course, is subjective since "fair" is not an absolute concept and tax data, depending how it's sliced, can tell different stories.

Those who say the rich pay their fair share point to the fact that the top 1% of taxpayers end up paying almost as much in federal income tax (and some years even more) as the bottom 95% combined.

Still, it's unlikely that even the most anti-tax, pro-wealth advocates would find this particularly fair: A very small number of millionaires end up owing no federal income tax at all.

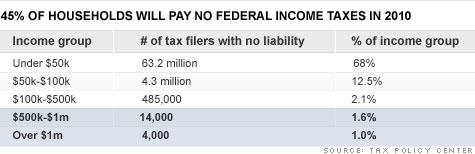

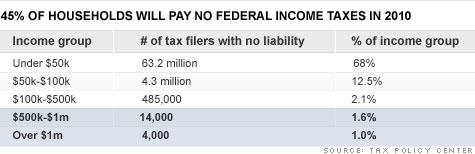

They're in good company, of course. Nearly half of all U.S. households, or 69 million, are estimated to have owed no federal income taxes for 2010. The vast majority of them, however, are low income.

But 18,000 were households taking in more than $500,000 -- and of those, 4,000 made more than $1 million.

How can it be that those with big income streams owed zip to Uncle Sam?

Janice Johnson and Jay Safier, members of the New York State Society of Certified Public Accountants, and Roberton Williams, a senior fellow at the Tax Policy Center, explained the likely reasons.

Such tax filers probably have big portfolios and big investment losses from the 2008 financial crisis. They are also more likely to be retired or self-employed, and may be charitably inclined.

America's richest tax breaks

What's common to all is that they likely qualify for the many tax breaks in the code that disproportionately benefit high-income households.

"A lot of these are people who probably made it very big on Wall Street years ago and who turned around and put it all in tax-exempt bonds," Johnson said.

Many of her clients are in their 50s or older, and "they're very leery of equity markets."

Williams offered a hypothetical example: A retired person with $10 million invested in municipal bonds paying 5% interest, or $500,000 a year.

"Because there is no limit on how much tax-exempt interest you can earn without having to pay taxes, she pays nothing to the federal government," he said.

Or it's possible that some of these tax filers have a large portfolio, and booked a lot of taxable gains in the recent run-up in stocks. But they were able to fully offset those gains with the many capital losses they realized during the financial crisis, which made even the most experienced investor want to take their marbles and go home.

Another possibility: A tax filer has a yen for foreign investments. Say he owns a dividend-paying foreign stock such as BP, Johnson said. The British government will withhold tax on the dividends that BP pays. To avoid being taxed twice on the dividend, the investor may be able to claim a foreign tax credit on her U.S. income tax return for the amount withheld.

"As long as the foreign tax exceeds her U.S. tax liability [on that dividend], she will pay nothing on her federal tax return" Williams said.

Johnson is also seeing a lot of people today who have left their jobs to start a business or become a consultant. Their self-employed paycheck -- not including income from their investments -- is far lower than their paychecks when they worked for The Man. And the tax owed on their new salary is more than offset by their mortgage interest and real estate tax deductions.

Safier noted there is another way such high-income households might substantially reduce their federal tax bite: giving to charity in a big way.

He noted two strategies. The first involves selling property to a charity below market value. That lets the seller treat a portion of the sale as a charitable contribution.

The second involves donating highly appreciated stocks to a charity. The tax filer can deduct the fair market value of the donated shares as a contribution without having to pay any capital gains.

At a time of record deficits, it's not unreasonable to say the rich should pay more, when the law allows even 1% of millionaires to owe nothing in federal income tax.

But keep in mind that boosting taxes on the rich by itself won't come close to solving the country's fiscal problems for a number of reasons. Most notably, there simply aren't enough of them.

AND BY THE WAY...

Top 10 Corporate Tax Freeloaders

Senator Bernie Sanders compiled a list of some of some of the 10 worst corporate income tax avoiders.

1) Exxon Mobil made $19 billion in profits in 2009. Exxon not only paid no federal income taxes, it actually received a $156 million rebate from the IRS, according to its SEC filings. (Source: Exxon Mobil's 2009 shareholder report filed with the SEC here.)

2) Bank of America received a $1.9 billion tax refund from the IRS last year, although it made $4.4 billion in profits and received a bailout from the Federal Reserve and the Treasury Department of nearly $1 trillion. (Source: Forbes.com here, ProPublica here and Treasuryhere.)

3) Over the past five years, while General Electric made $26 billion in profits in the United States, it received a $4.1 billion refund from the IRS. (Source: Citizens for Tax Justice here and The New York Times here. Note: despite rumors to the contrary, the Times has stood by its story.)

4) Chevron received a $19 million refund from the IRS last year after it made $10 billion in profits in 2009. (Source: See 2009 Chevron annual report here. Note 15 on page FS-46 of this report shows a U.S. federal income tax liability of $128 million, but that it was able to defer $147 million for a U.S. federal income tax liability of $-19 million)

5) Boeing, which received a $30 billion contract from the Pentagon to build 179 airborne tankers, got a $124 million refund from the IRS last year. . (Source: Paul Buchheit, professor, DePaul University, here and Citizens for Tax Justice here.)

6) Valero Energy, the 25th largest company in America with $68 billion in sales last year received a $157 million tax refund check from the IRS and, over the past three years, it received a $134 million tax break from the oil and gas manufacturing tax deduction. (Source: the company's 2009 annual report, pg. 112, here.)

7) Goldman Sachs in 2008 only paid 1.1 percent of its income in taxes even though it earned a profit of $2.3 billion and received an almost $800 billion from the Federal Reserve and U.S. Treasury Department. (Source: Bloomberg News here, ProPublica here, Treasury Department here.)

8) Citigroup last year made more than $4 billion in profits but paid no federal income taxes. It received a $2.5 trillion bailout from the Federal Reserve and U.S. Treasury. (Source: Paul Buchheit, professor, DePaul University, here, ProPublica here, Treasury Department here.)

9) ConocoPhillips, the fifth largest oil company in the United States, made $16 billion in profits from 2006 through 2009, but received $451 million in tax breaks through the oil and gas manufacturing deduction. (Sources: Profits can be found here. The deduction can be found on the company's 2010 SEC 10-K report to shareholders on 2009 finances, pg. 127,here)

10) Over the past five years, Carnival Cruise Lines made more than $11 billion in profits, but its federal income tax rate during those years was just 1.1 percent. (Source: The New York Times here)

No comments:

Post a Comment